Commercial mortgage how much can i borrow

Types of commercial mortgages. The conforming limit set by Fannie Mae and Freddie Mac guidelines for a 1-unit property is 647200 for most of the country If you have a higher credit score and can meet the needed down payment a jumbo loan may pave the way to your dream home.

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

There are several key ratios that lenders consider when determining your ability to obtain a mortgage loan.

. The results shown are based on information and assumptions provided by you regarding your goals expectations and financial situation. However as a drawback expect it to come with a much higher interest rate. Costs associated with getting a mortgage.

Find a mortgage loan officer. As a general rule your total monthly expenses should not exceed 43 of your gross monthly income. This calculator estimates your borrowing power based on your income financial commitments and loan details entered.

Earlier we mentioned that commercial mortgage rates are typically 75 to 125 basis points higher than residential mortgage rates. This mortgage finances the entire propertys cost which makes an appealing option. Loan to Value LTV This is the amount of the mortgage expressed as a percentage of the property value.

Finding the perfect home should be the hard part of your home buying experience. What Vehicle Can I Afford. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage.

How much youre able to borrow depends on your net operating income the type of real estate youre using as collateral and your propertys value in comparison to the loan amount. LMI capitalisation is when the LMI premium is added to the mortgage instead of paying it upfront. These mortgages are a way for businesses to borrow over a certain amount say 25000 with the lender using your business property as security.

The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. 31000 23000 subsidized 7000 unsubsidized Independent. Therefore if the 30-year conforming mortgage rate is 40 today then commercial mortgage rates would be around 475 to 525.

We offer 30-year construction mortgage 15-year construction mortgage or a 51 Adjustable Rate Mortgage ARM. Access a high-LTI mortgage. Should you use a mortgage broker.

Note that your monthly mortgage payments. Most commercial mortgage facilities charge a lender arrangement fee also known as a facility fee acceptance fee or booking fee which is usually a percentage of the mortgage amount being borrowed and added to the facility. There are several reasons you might consider using a mortgage broker or mortgage adviser not least because it can transition the stress of finding the best mortgage onto a third party.

Heres a breakdown of what you might face monthly in interest and over the life of a 200000 mortgage. When you start the car-buying process you might wonder what you can afford given your financial situation. You can put down a deposit of 25 feasible for homeowners trading up in expensive housing areas.

Commercial Mortgage Interest Rates. This can be used in conjunction with our loan repayment calculator to help you to work out your repayments based on the amount you wish to borrow. Personal loans can be used to borrow anywhere from say 1000 to 25000.

Use this LMI calculator to calculate lenders mortgage insurance and stamp duty you may incur when buying a property or refinancing. You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit. If applicable please enter the arrangement fee as a percentage this will then be added to the total mortgage facility.

A specialist commercial mortgage broker can help you find the best deal and will present your application to the lender to increase its likelihood of being accepted. Northwest offers a variety of loans to address your unique needs and financial qualifications. Read our How much can I borrow for a mortgage guide to find out more about what can impact your potential sum of borrowing.

It is provided as a self-help tool for your independent use. We believe securing a home loan should be easy. Find the right mortgage fit for you in the chart below.

Using a percentage of your income can help determine how much house you can afford. Most commercial mortgage amounts range between 150000 and 5000000. We can find you a mortgage offer with several lenders offering deals equivalent to five times your salary if you earn at least 75000.

Their fee is normally up. Find out what a delegated loan is and how you can get approval. Monthly payments on a 200000 mortgage.

After performing the calculation you can transfer the results to our mortgage comparison calculator where you can compare all the latest mortgage rates. For example the 2836 rule may help you decide how much to spend on a home. Enter your details in the calculator to estimate the maximum mortgage you can borrow.

Calculate how much you can borrow. Our Home Affordability calculator can help determine how much home you can afford. What Renters and Homeowners Need to Know.

How much house can I afford. Mortgage loans can be divided into two categories. The same rate will apply for your construction and permanent financing.

This is used to buy property that will be used as trading premises for your business. Please get in touch over the phone or visit us in branch. Total subsidized and unsubsidized loan limits over the course of your entire education include.

So how can you be one of that 15. While every mortgage lender has their own criteria for determining how much you can borrow they all look at the following key factors when calculating a buy to let mortgage. A basis point is 1100th of one percent so 125 basis points is 125.

Borrowing power calculator - How much can I borrow. Jumbo Loan A jumbo loan is what it sounds likebig meaning bigger than what would ordinarily be the limit. Well work with you to finance the home of your dreamseven if it doesnt exist yet.

Only one closing is required. At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 95483 a month while a 15-year term might cost a month. To help you set your budget for a new or used car use our Car Affordability Calculator and enter how much you can pay per month and how much you can put down on the vehicle to get a better idea of your total.

Natural Disasters and Your Home.

Happy Smallbusinessweek Creditunions Commercialleding Oaktreeforms Https Youtu Be E0za10l0lha 80 Commercial Lending Business Systems Small Business Week

Commercial Mortgages In Canada Loans Canada

Equitable Mortgage Registration Mortgage Mortgage Loans The Borrowers

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

Moneylend A Search Engine For Online Business Personal Loans Personal Loans Online Business Search Engine

Did You Know You Can Borrow For Major Expenses Like Education Expenses Home Renovation Or Weddings Through Ho Home Equity Home Improvement Loans The Borrowers

Think Like A Lender To Get Your Commercial Real Estate Suit Jacket Borrow Money Interest Only Mortgage

One Of The Most Preferred Option For Borrowing Funds Loan Against Property In India Helps Individuals Meet Their Financia How To Raise Money Loan Secured Loan

99c Read Free On Kindleunlimited Book Deciding If You Should Refinance Your Mortgage By Tony Faso Fina Promote Book Free Book Promotion Kindle Reading

Business Loans Flat Concept Icon In 2022 Business Loans Loan Concept

Self Employed Mortgage How Much Can I Borrow The Borrowers Self Mortgage

Pin On Commercial And Residential Hard Money Loan In New Jersey

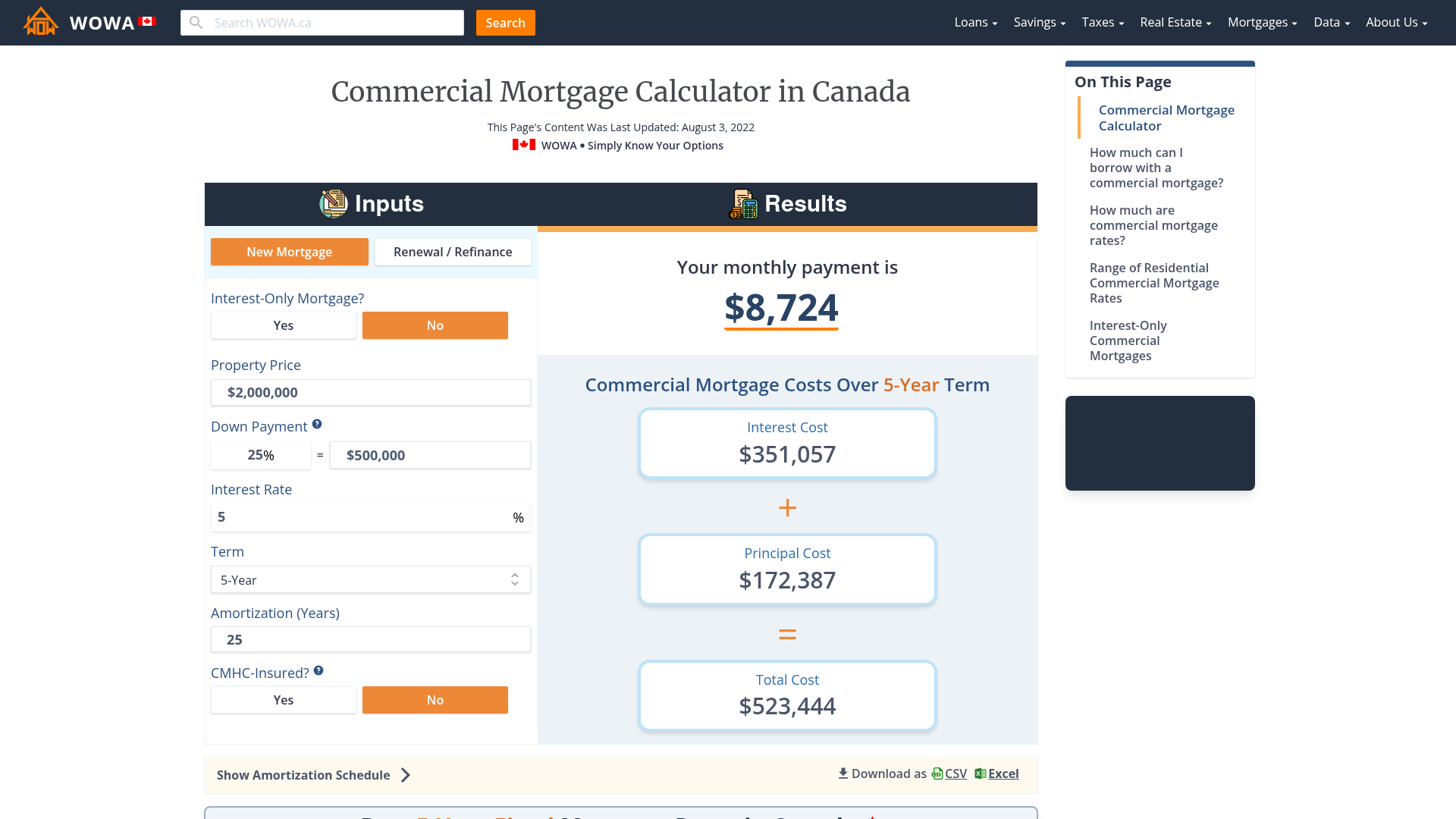

Commercial Mortgage Calculator Payment Amortization

Infographic 10 Steps To Buying A Home In The Uk Home Buying Infographic 10 Things

Didyouknow Realestatiekatie Real Estate Marketing Quotes Real Estate Business Plan Getting Into Real Estate

Real Estate Infographic On Prequalification Vs Preapproval Real Estate Infographic Real Estate Tips Real Estate Investing

Tips For First Time Home Buyers Applying For A Mortgage In 2022 Successful Business Tips Real Estate Quotes Home Buying Tips